franklin county ohio sales tax rate 2020

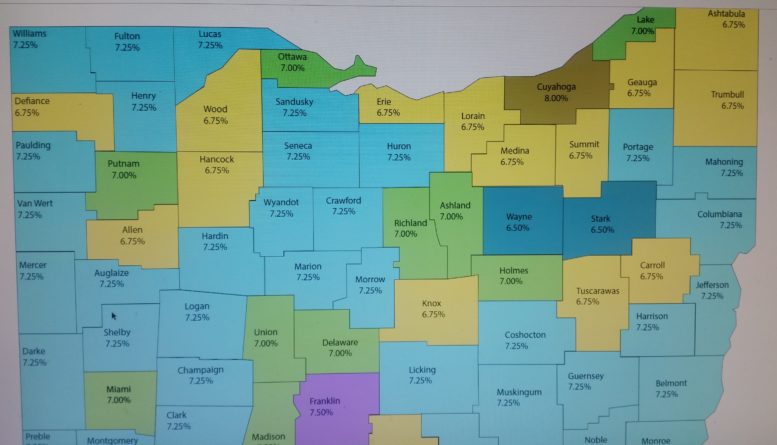

ZIP County Rate ZIP County Rate ZIP County Rate ZIP County Rate County Rate Table by ZIP Code August 2022 43001 Licking 725 43002 Franklin 750 43003 Delaware 700 43003. The Franklin County Sales Tax is 125.

Washington Sales Tax Guide For Businesses

There were no sales and use tax county rate changes effective July 1 2020.

. A full list of these. Franklin OH Sales Tax Rate The current total local sales tax rate in Franklin OH is 7000. Ad Automate tax rules compliance with help from Avalara.

Ohio recently raised the state sales tax by 025 from 55 to 575. A A A. Franklin County Treasurer - Property Search.

Franklin Countys is 75. Geographic Information System Auditor. Every six years Ohio law mandates a Sexennial Reappraisal ORC 5713 with a Triennial Update on the third-year midpoint of the six-year cycle to update values to reflect the current real.

Billing Address CORELOGIC PO BOX 9202 COPPELL TX. This is the total of state and county sales tax rates. Franklins Income Tax Rate is 2 effective July 1 2011.

Ohio Sales Tax Ust 1 Fill Out Printable Pdf Forms Online. The December 2020 total local sales tax rate was also 7000. Marriage Licenses Probate Court.

John Smith Street Address. The December 2020 total local sales tax rate was also 7500. 1 Benjamin Franklin Way Franklin Ohio 45005.

You can print a 7 sales tax table here. The sales tax rate for Franklin County was updated for the 2020 tax year this is the current sales tax rate we are using in the Franklin. Location Address 2892 HAMPSHIRE RD OH.

The state gets 575 percent which is the rate for all counties. Some cities and local. Adoptable Dogs Animal Control.

As for zip codes there are around 56 of them. 2nd Quarter effective April 1 2020 - June 30 2020 Rates listed by county and transit authority. The minimum combined 2022 sales tax rate for Franklin Ohio is.

Cheryl Brooks Sullivan. The Franklin County sales tax rate is 125. The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax.

If you have any questions regarding your property taxreal estate tax. Franklin County OH Sales Tax Rate The current total local sales tax rate in Franklin County OH is 7500. Average Sales Tax Summary Franklin County is located in Ohio and contains around 14 cities towns and other locations.

123 Main Parcel ID. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange. Franklin 125 050 750 Putnam 125 700 Fulton 150 725 Richland 125 700 Gallia 150 725 Ross 150 725.

The December 2020 total local sales tax rate was also 7500. City of Columbus and Franklin County Facilities Authority Hotel-Motel Excise Tax. A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax.

Counties and cities as well as mass transit districts in Ohio are allowed to charge an additional local sales tax on top of. What is the sales tax rate in Franklin County. This is the total of state county and city sales tax rates.

Adult Protective Services Office on Aging. The County sales tax rate is. What county in Ohio has the lowest sales tax.

The minimum combined 2022 sales tax rate for Franklin County Ohio is. The tax rate was increased to 4 effective September 1 1980 and to. The Ohio sales tax rate is currently.

Sales tax in Franklin County Ohio is currently 75. Franklin County in Ohio has a tax rate of 75 for 2022 this includes the Ohio Sales Tax Rate of 575 and Local Sales Tax Rates in Franklin County totaling 175. 6 rows The Franklin County Ohio sales tax is 750.

With a prebuilt integration and free trial getting started may be easier than you think. Ad Automate tax rules compliance with help from Avalara. With a prebuilt integration and free trial getting started may be easier than you think.

May 11 2020 TAX. Butler County along with Stark and Wayne. There is no applicable city tax or special tax.

The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax.

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Ohio Sales Tax Rates By City County 2022

Ohio Sales Tax Small Business Guide Truic

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Wood County Likes Its Status On Low Sales Tax Island Bg Independent News

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Ohio Tax Rates Rankings Ohio State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Greater Dayton Communities Tax Comparison Information

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation